Our history

WITHDRAWING FROM NUCLEAR ENERGY

The German government puts its energy policy on course for entry into the age of renewable energies. Nuclear energy was assigned a bridging role until renewable energies can assume their role reliably and economically and the necessary energy infrastructure is available.

REACTOR ACCIDENT AT THE FUKUSHIMA NUCLEAR POWER PLANT

After the reactor accident at the Fukushima nuclear power plant in March 2011, German politic conducted a reassessment of the remaining risks of nuclear power. The German government initiates the final phase-out of nuclear energy.

FINANCIAL RESPONSIBILITY FOR NUCLEAR WASTE LIABILITIES

Legal experts commissioned by the Federal Ministry of Economics and Technology have proposed the introduction of a statutory group liability, an intra-group security fund and a public-law fund. The German government has also commissioned an auditing firm to analyze the total costs of disposal. Legal experts commissioned by the Federal Ministry of Economics and Technology have proposed the introduction of a statutory group liability, a group-internal security fund and a public law fund. The German government has also commissioned an auditing firm to analyze the total disposal costs.

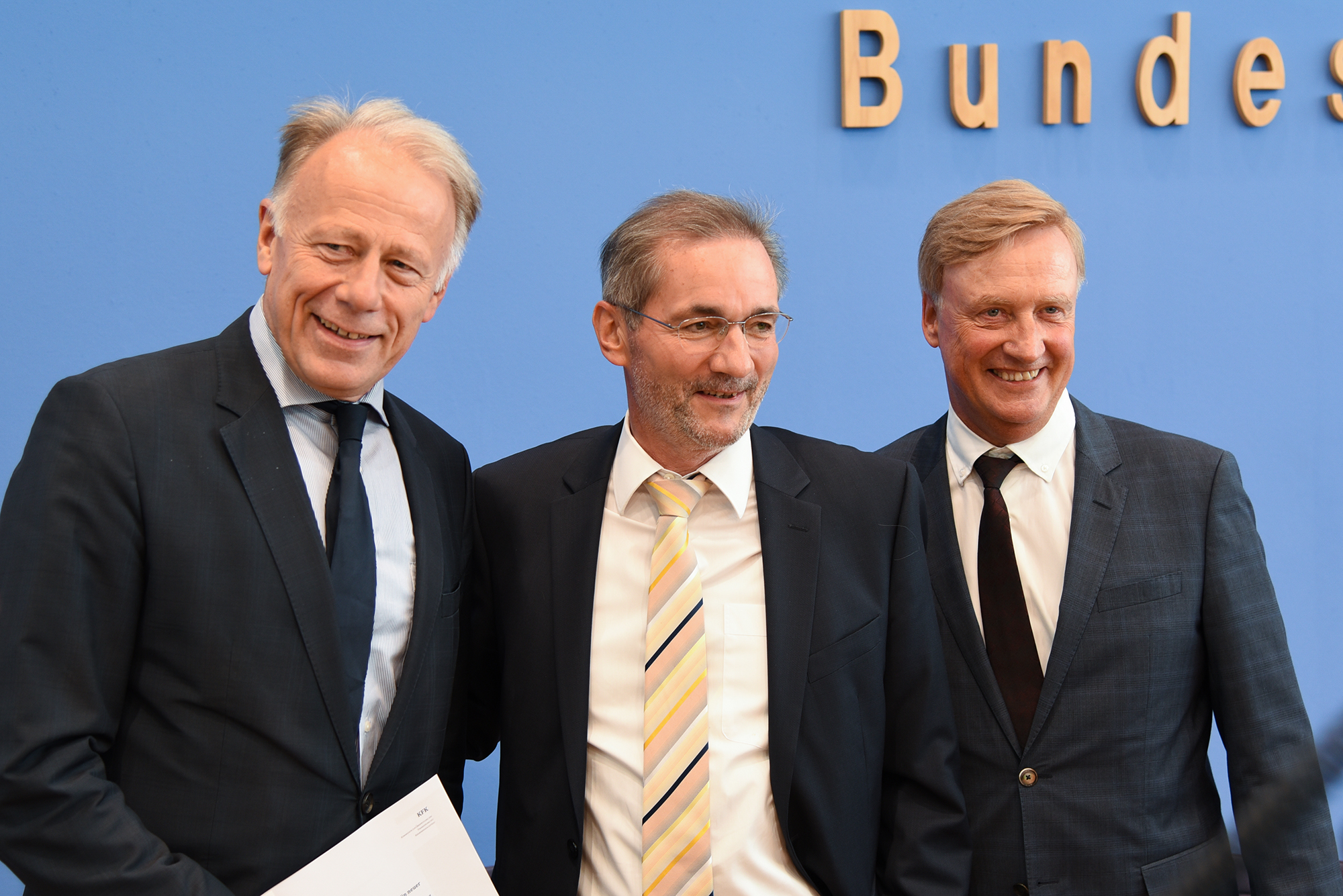

COMMISSION REVIEWING THE FINANCING OF THE NUCLEAR PHASE-OUT (KFK)

The KFK recommended that a public law foundation should be set up. This “could be set up in a slimmed down manner“ and would “provide better protection than a special fund, mainly against greed and outside interference“.

THE FORMATION OF KENFO

The German Nuclear Waste Management Fund was established on 16 June 2017 and starts its operation in the premises of the Federal Ministry of Economics. On July 3, 2017, payments for the obligations of the 25 nuclear power plants in Germany totaling EUR 24.1 billion are received from the energy supply companies on KENFO’s accounts.

DETERMINATION OF THE ABBREVIATED NAME "KENFO"

The Board of Trustees establishes the short name KENFO as an abbreviation of the legal name "Nuclear Waste Management Financing Fund" (Fonds zur Finanzierung der kerntechnischen Entsorgung).

RESOLUTION ON ESG PRINCIPLES

On June 2, 2019, the Board of Trustees adopts the "ESG Principles" and sets out the fundamentals of the sustainability approach in ten points, in particular that the Fund will support investments to achieve the Paris climate targets as part of its legal mandate.

RELOCATION TO OWN PREMISES IN WEST BERLIN

In mid-June, KENFO moves out of the premises provided by the Federal Ministry of Economics and Technology to it as "start-up aid", which were infeasible with respect to the employee growth. The new offices in the "Lenzhaus," Berlin's first high-rise office building in the avant-garde Art Deco style from the 1920s, are located in western Berlin in the close neighborhood of Kurfürstendamm and KaDeWe.

JOINING THE NET-ZERO ASSET OWNER ALLIANCE AND UN PRINCIPLES FOR RESPONSIBLE INVESTMENT (UN PRI)

By joining the Net-Zero Asset Owner Alliance, KENFO commits to reducing the carbon emissions of its investment portfolio to net zero by 2050. In its sustainability principles, KENFO commits to the Paris climate goals. The UN-backed Principles for Responsible Investment (PRI) is an international investor initiative that has at its core six principles for responsible investing that include numerous measures to incorporate ESG (environment, social, governance) issues into investment practices.

CORONA CRISIS DEFIED

The Corona crisis also poses challenges for KENFO, yet KENFO's financial investments are up since inception and they will close the first Corona year with a positive performance of 8.3%.

CARBON FOOTPRINT REDUCTION TARGETS SET

KENFO, as a member of the UN-convened Net-Zero Asset Owner Alliance (AOA), has set an initial interim target for reducing its carbon footprint: By the end of 2024, it aims to reduce the carbon footprint of its equity and corporate bond portfolio, measured as of Dec. 31, 2019 and submitted to the AOA, by 20 percent.

ESG AWARD RECEIVED

For its sustainability approach and the "ESG Criteria Implementation 2020 and 2021", KENFO receives the "Institutional assets Award" of Deutsche Pensions & Investmentnachrichten (dpn) and is recognized for a convincing and responsible consideration of social, environmental and governance aspects in the orientation of its investments.